M.I.A.M.I. = Money is a major issue

I didn’t make this acronym up… I appropriated it from Cuban American rapper Pitbull. And now we’re about to remix this topic – hip hop style – and talk about how much of a major issue money is when it comes to grad school, career, your life, and beyond.

Make no mistake – in this society we live in – money is a major issue. How much of it do you want to amass to support the lifestyle you want to live?

The truth is… when it comes down to lifestyle design, the majority of us out here don’t have ambitions to have Bill Gates money. Well, we aren’t gonna turn it down if offered. Let me speak for myself – *I’m* not turning it down.

We all want to live comfortably. Part of the equation to happiness is to minimize financial stress. There are a ton of stresses looming in our daily life – mortgages, credit cards, student loans, car payments, insurance premiums, rising costs of gas just to get to work in the first place. Need I go on?

Let me go out on a limb and say that anyone who isn’t concerned about how much financial freedom their education affords them is a dummy. It’s not PC to call folks dummies… but, ah, oh well. Tell me I’m wrong.

Earning potential based on education

What does taking your education to the next level mean to you in terms of securing financial freedom? A whole heckuva lot. If you’re still on the fence about pursuing an advanced degree, maybe some of these stats will sway your decision.

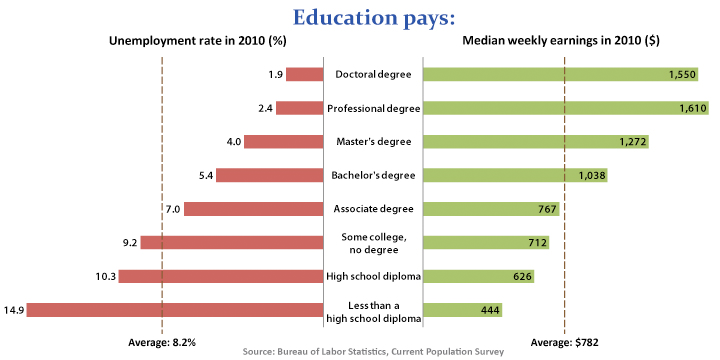

Education pays in higher weekly earnings and lower rates of unemployment according to the U.S. Department of Labor Statistics. And check out how much more college grads, specifically those with graduate degrees, earn over and above the national average:

Still not convinced? It’s definitely a smart move to think critically about statistics. So I did some analysis of my own. I know how much my salary was for my first job coming out of a Ph.D. program and it was *nowhere* near the average quoted by the U.S. Census.

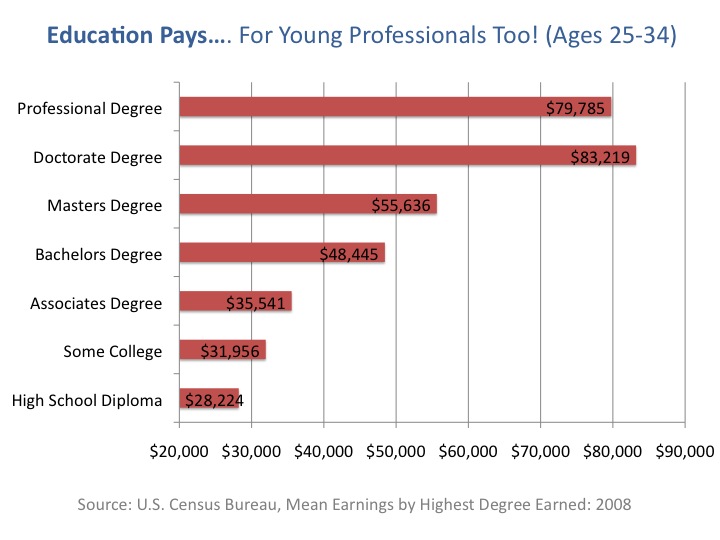

So how about we take out those folks who have been in their careers for 10-20+ careers with years’ worth of experience and several promotions underneath their belt. On average, how much do young professionals stand to make fresh out of grad school with an advanced degree? Let’s take a look at the stats for those right at the beginning of their careers – ages 25-34:

Count ’em – that’s $55K on average for masters degree holders, $79K for professional degree recipients, and a cool $83K per year for doctoral degrees.

Let me be up front and say this before you start counting pennies you haven’t earned yet: *Every* young professional with advanced degrees isn’t making this much on paper. The average for doctorate degree recipients is probably skewed by folks with Ph.D.’s in the hard sciences, business, engineering and other disciplines who tend to earn much more than Ph.D.’s in humanities or social sciences. And yes, Ph.D.’s in social sciences, such as myself, hold just a tiny bit of resentment for the difference in pay. Just a little.

Lifetime earning potential tells an even more drastic story on how life changing a graduate education can be. Figures quoted in the U.S. Census’s report on The Big Payoff: Educational Attainment and Synthetic Estimates of Work-Life Earnings are a bit dated (2002) but take a look at these apples:

- H.S. grads = $1.2 million earned over a lifetime

- Bachelors degree = $2.1 million earned over a lifetime

- Masters degree = $2.5 million earned over a lifetime

- Doctorate degrees = $3.4 million earned over a lifetime

- Professional degrees = $4.4 million earned over a lifetime

Over a lifetime, earning an advanced degree in the form of a professional degree or doctorate degree boosts your income well over $1 million! Guess its time to start pursuing your next degree, right?

Higher education debt burden

Undoubtedly, student loans are also a major issue. Ask any young professional still in the debt repayment stage of their career. It is far too easy to rack up close to hundreds of thousands of dollars in debt by the time you’ve completed grad school. Even still, most people would say that taking on the additional debt is worth it in the long run, even if it takes several years to pay the loans back down to zero.

Of course, going to graduate school isn’t the only way to bolster your earnings profile. Ask any financially successful entrepreneur. But let’s say that your calling in life is to educate, explore the unanswered questions of life, and produce meaningful research to fill in the gaps. Or maybe your dream is to carry on the legacy of a Fortune 500 company that you believe in. You need the educational pedigree and professional connections that graduate school affords you.

How much is it costing you to NOT go to grad school?

It could easily be over one million dollars. How much financial freedom would one million dollars buy over the course of your lifetime?

Your million dollars may not show up as lump sum like winning the lottery or even show up as a money in the bank, but in the form of better quality of life for you and your family, more leisurely vacations that preserve your sense of psychological well-being, priceless once-in-a-lifetime experiences like sitting in the front row to see your favorite performer, or the ability to provide quality care for your parents when they are no longer able to care for themselves.

It’s not a big stretch of the imagination to say that an extra million dollars can very literally change the course of your life.

M.I.A.M.I. when it comes to pursuing graduate education. If you’ve made the decision to continue your education but need clear direction and planning for your next steps, let’s talk about how I can help you get into grad school, and on your way to earning your first million.